How to Get Hired in Finance: Your Complete Action Plan

Table of Contents

The Finance Hiring Reality

Let’s be honest: Finance jobs are competitive. For every opening at HDFC Bank or Goldman Sachs, there are 100+ applicants. But here’s the good news—most applicants don’t prepare properly.linkedin

If you follow this guide, you’ll be in the top 10% of candidates.

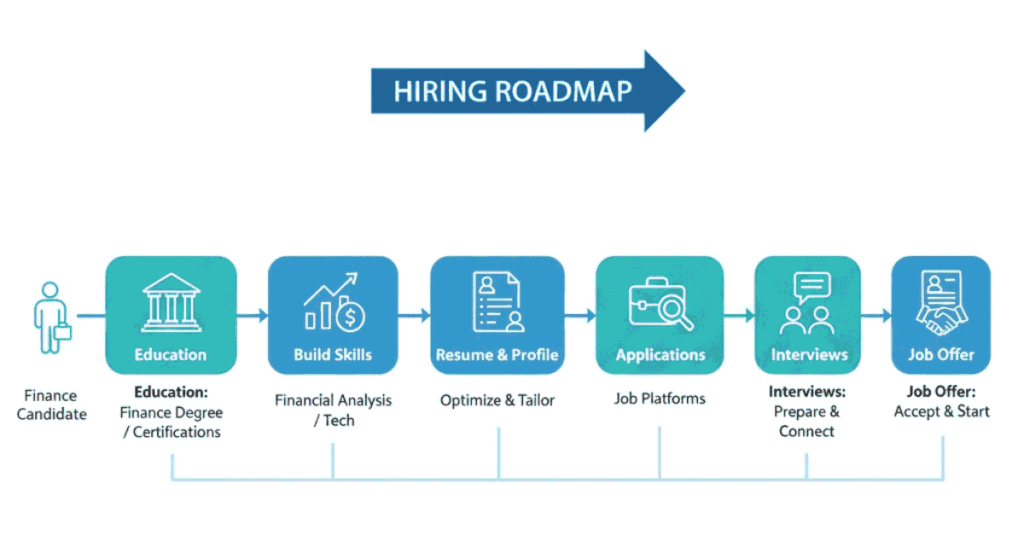

Phase 1: Build Your Foundation (6-12 Months Before Job Search)

- Get the Right Education

Minimum requirement:

- Bachelor’s degree (any stream, but BCom/BBA preferred for most finance roles)

- Good GPA (3.0+ or 60%+)

Bonus credentials:

- MBA (Finance) – Opens doors to senior roles

- CA/CPA/CMA – Strong advantage for accounting/corporate finance roles

- CFA Level 1 – Shows commitment to finance careercentury-group

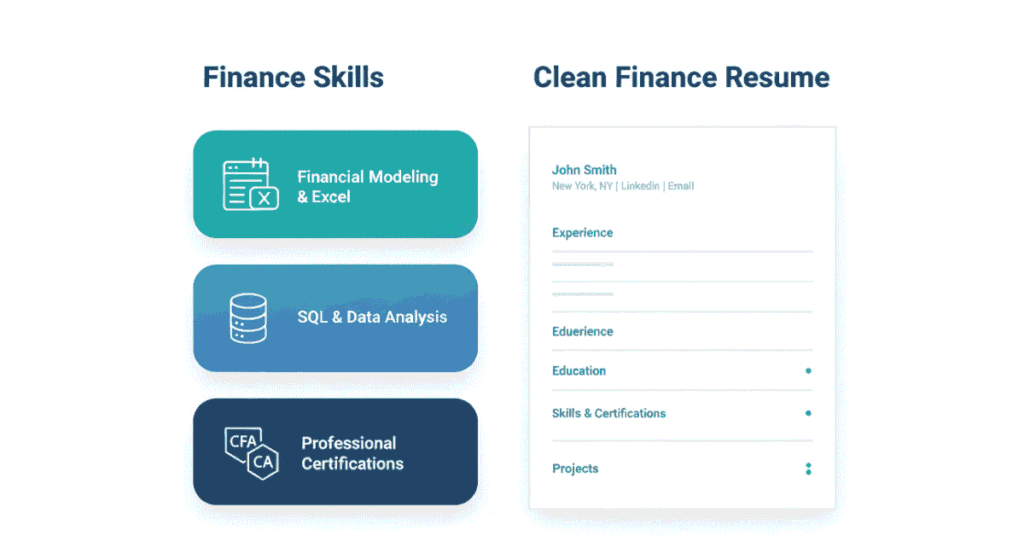

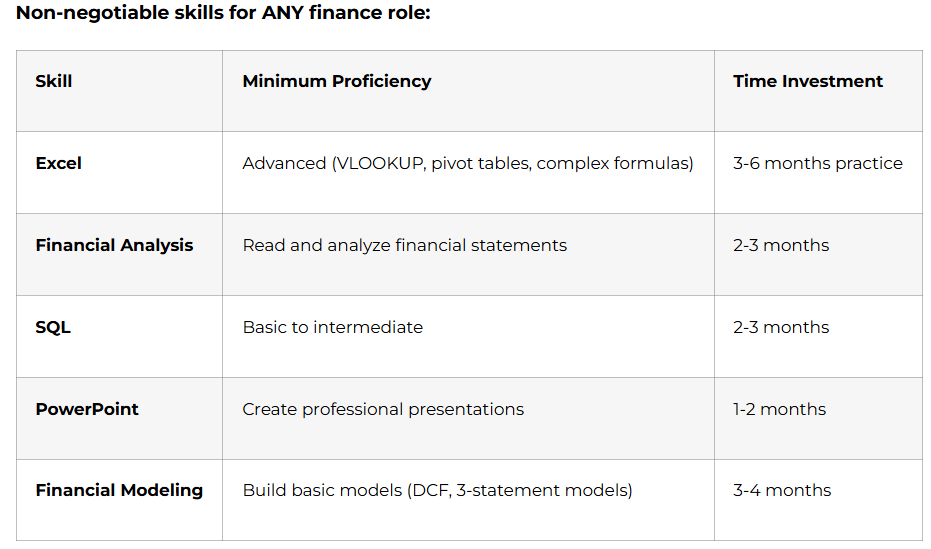

- Build Technical Skills

- Get Real-World Experience

Internships (Critical!):

- Apply to 50+ companies (banks, FinTech, corporate finance departments)

- Even 2-month internship is valuable

- Many companies convert interns to full-time (30-50% conversion rate)

Projects (If you can’t get internship):

- Analyze public company financials

- Build investment portfolio

- Create financial models

- Write investment thesis

- Publish on LinkedIn or personal blog

Phase 2: Create a Winning Resume

Finance Resume Structure (1 Page)

Header:

- Name, phone, email, LinkedIn, location

- Keep it clean and professional

Summary (2-3 lines):

Example: “Finance graduate with CFA Level 1 certification and 6 months internship experience in financial analysis. Proficient in Excel, SQL, and financial modeling. Seeking Financial Analyst role in banking or corporate finance.”

Education:

- Degree, University, Graduation year, GPA (if 3.0+)

- Relevant coursework (Corporate Finance, Financial Markets, Accounting)

- Certifications (CFA Level 1, NISM, SQL)

Experience:

- List in reverse chronological order

- Use action verbs (Analyzed, Built, Developed, Led)

- Quantify impact (“Analyzed 50+ company financial statements” not just “Analyzed companies”)

Skills:

- Technical: Excel (Advanced), SQL, Python, Financial Modeling, Bloomberg Terminal

- Finance: Financial Analysis, Valuation, Risk Management

- Soft Skills: Communication, Problem-solving, Team Leadership

Pro tips:

- Use numbers and metrics everywhere possible

- Tailor resume for each job (use keywords from job description)

- No spelling/grammar errors (use Grammarly)

- PDF format only

- Clean, readable font (Arial, Calibri, Times New Roman)

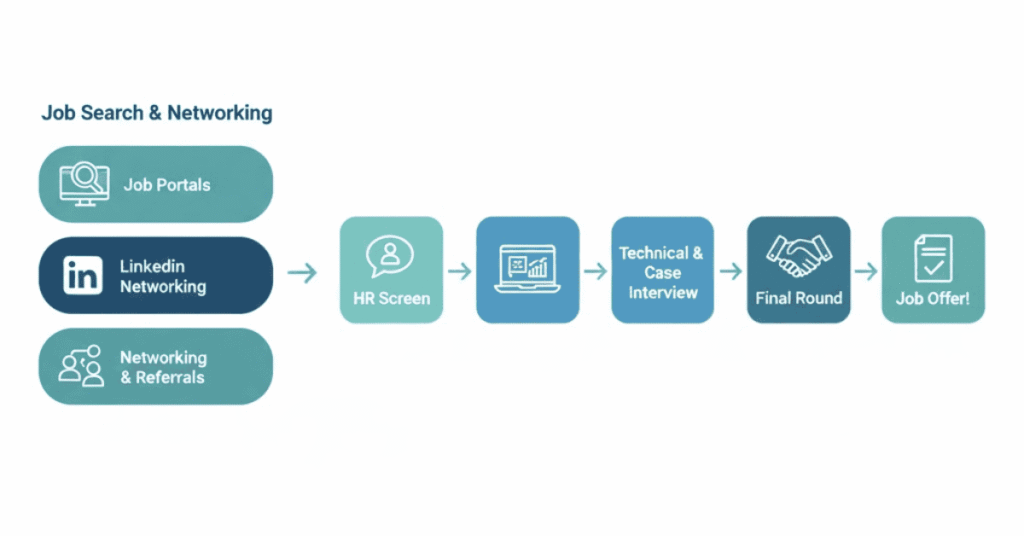

Phase 3: Apply Strategically

Where to apply:

Job Portals:

- LinkedIn Jobs (best for finance roles)

- Naukri.com

- Indeed

- AngelList (for startups/FinTech)

- Company career pages directly

Application strategy:

- Apply to 5-10 jobs per day (targeted, not spray-and-pray)

- Customize each application

- Follow up after 1 week if no response

- Track applications in spreadsheet

Networking (Most Important!):

- 70% of jobs are filled through referrals, not job boards

- Connect with alumni working in finance

- Reach out to professionals on LinkedIn

- Attend finance events and meetups

- Ask for informational interviews

LinkedIn networking message template:

“Hi [Name],

I’m a finance graduate interested in [specific role] at [Company]. I noticed you work in [their role] and would love to learn about your experience.

Would you be open to a 15-minute call? I’d greatly appreciate any insights you could share.

Thank you!

[Your Name]”

Phase 4: Ace the Interview

Round 1: HR Screen (20-30 minutes)

Common questions:

- “Tell me about yourself” (2-minute professional story)

- “Why finance?” (Show genuine interest)

- “Why this company?” (Research beforehand!)

- “What are your strengths/weaknesses?”

- “Where do you see yourself in 5 years?”

Pro tip: Prepare STAR format stories (Situation, Task, Action, Result) for behavioral questions.

Round 2: Technical Interview (45-60 minutes)

Topics you MUST know:

Accounting basics:

- Three financial statements (Balance Sheet, P&L, Cash Flow)

- How they connect

- Key ratios (P/E, ROE, Debt-to-Equity, Current Ratio)

Valuation:

- DCF (Discounted Cash Flow) basics

- Comparable company analysis

- P/E multiple valuation

Finance concepts:

- Time value of money

- Risk vs. return

- Capital structure

- Working capital

Sample questions:

- “Walk me through a DCF model”

- “How are the three financial statements connected?”

- “What happens to the three statements if inventory increases by ₹10 crore?”

- “How would you value a company?”

- “What’s the difference between EBIT and EBITDA?”

Pro tip: Practice on actual company financials. Download annual reports and analyze them.

Round 3: Case Interview (Investment Banking, Consulting)

What to expect:

- Business problem to solve

- Market sizing (“How many credit cards are there in Mumbai?”)

- Profitability analysis

- Investment decision

Framework to use:

- Clarify the question

- Structure your approach

- Do calculations (show your work)

- Make recommendation

- Discuss implications

Example case:

“A retail company is considering opening 100 new stores. Should they do it?”

Your approach:

- Clarify: What’s their current performance? Which cities? Investment required?

- Structure: Analyze costs vs. revenue potential

- Calculate: Break-even analysis, ROI

- Recommend: Yes/No with reasoning

- Discuss: Risks, alternatives, next steps

Pro tip: Practice with case interview books (Case in Point, Case Interview Secrets)

Round 4: Final Interview (With Senior Management)

What they’re evaluating:

- Cultural fit

- Long-term potential

- Communication skills

- Passion for finance

Questions to expect:

- “Why should we hire you?”

- “What unique value do you bring?”

- “Tell me about a time you failed”

- “What questions do you have for us?” (ALWAYS have 2-3 intelligent questions!)

Good questions to ask:

- “What does success look like in this role in the first year?”

- “What are the biggest challenges the team is facing?”

- “How does this role contribute to company strategy?”

- “What’s the career path for someone in this position?”

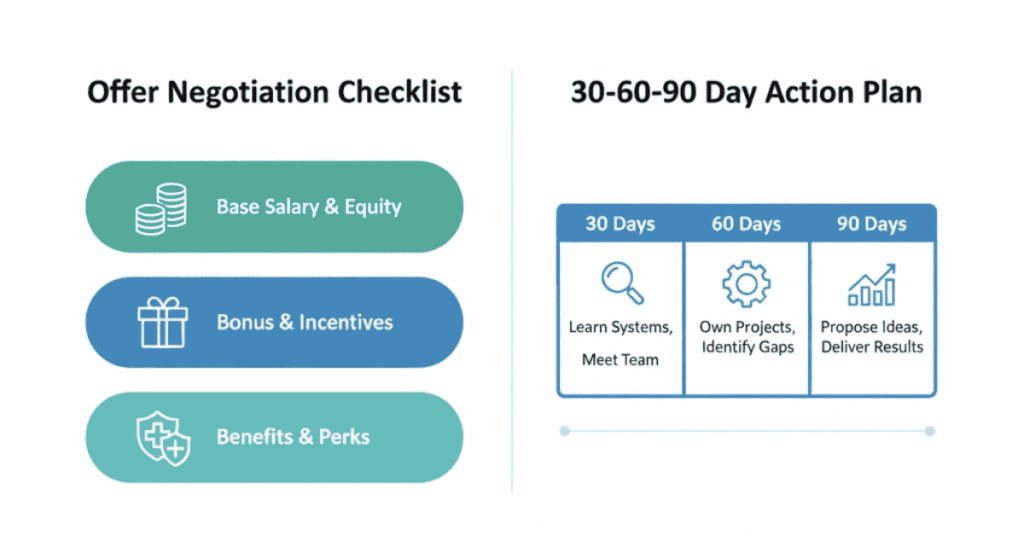

Phase 5: Negotiate Your Offer

When you receive an offer:

Step 1: Don’t accept immediately

- Thank them and ask for 2-3 days to review

- This shows you’re thoughtful, not desperate

Step 2: Research market rates

- Check Glassdoor, AmbitionBox, Payscale

- Talk to people in similar roles

- Know your worth

Step 3: Negotiate professionally

Template:

“Thank you for the offer. I’m very excited about this opportunity. Based on my research and the value I bring [mention specific skills/experience], I was expecting compensation in the range of ₹X-Y LPA. Is there flexibility in the offer?”

What to negotiate:

- Base salary (most important)

- Signing bonus

- Performance bonus

- Benefits (health insurance, PF)

- Work-from-home days

- Learning budget

Pro tips:

- Always negotiate (companies expect it)

- Be confident but respectful

- Have alternative offer as leverage (if possible)

- Know your minimum acceptable number before negotiating

Finance Interview Questions You MUST Prepare

Technical Questions (Top 20):

- What are the three financial statements?

- How are they connected?

- Walk me through a DCF model

- What’s WACC and why does it matter?

- Explain enterprise value vs. equity value

- What happens if depreciation increases by ₹10?

- What are the main valuation methods?

- How do you value a company with no revenue?

- What’s the difference between EBIT and EBITDA?

- Explain working capital

- What’s a good P/E ratio?

- How would you assess a company’s financial health?

- What’s the difference between equity and debt?

- Explain risk and return

- What are the key financial ratios?

- How do interest rates affect stock prices?

- What’s the time value of money?

- Explain beta and correlation

- What causes stock prices to change?

- How would you value a bank?

Behavioral Questions (Top 10):

- Tell me about yourself

- Why finance?

- Why this company?

- Tell me about a time you failed

- Describe a challenging project

- How do you handle pressure?

- Tell me about a time you led a team

- Describe a conflict and how you resolved it

- What’s your greatest strength/weakness?

- Where do you see yourself in 5 years?

30-Day Finance Job Search Plan

Week 1: Preparation

- Finalize resume

- Set up LinkedIn profile

- Research target companies (20-30)

- Prepare answers to common questions

- Study technical concepts

Week 2: Applications & Networking

- Apply to 5-10 jobs daily

- Reach out to 5 professionals on LinkedIn daily

- Attend 1-2 finance networking events

- Practice interview questions

Week 3: Interviews

- Interview prep (technical + behavioral)

- Mock interviews with friends

- Research companies you’re interviewing with

- Continue applications

Week 4: Follow-ups & More Applications

- Follow up on applications

- Send thank-you emails after interviews

- Continue networking

- Apply to backup options

FAQs: Finance Careers

Q1: Can I get into finance without a finance degree?

A: Yes! Many successful finance professionals have engineering, arts, or science backgrounds. What matters: strong analytical skills, willingness to learn, and relevant certifications (CFA, NISM).imperialbschool

Q2: What’s the fastest path to high salary in finance?

A: Investment banking or FinTech roles offer fastest salary growth. IB analysts can reach ₹50+ LPA in 8-10 years. FinTech offers equity upside.imperialbschool+1

Q3: Is finance a good career in 2025?

A: Yes. Finance offers high salaries (₹6-100+ LPA), job security, diverse paths, and global opportunities. Demand is growing with 72% of employers expanding teams.imperialbschool

Q4: Should I do CA or MBA?

A: Depends on goals. CA for accounting/audit focus, technical depth, independent practice. MBA for leadership roles, networking, broader business knowledge.amityonline

Q5: How long to become CFO?

A: Typically 12-20 years. Path: Analyst (2 yrs) → Senior (3 yrs) → Manager (4 yrs) → Director (5 yrs) → VP (3 yrs) → CFO.300hours

Q6: Can I switch from tech to finance?

A: Absolutely! FinTech needs tech people who understand finance. Learn financial concepts, apply to FinTech companies, or pursue finance certifications.siecindia

Q7: What’s better: Banking or FinTech?

A: Banking: stability, structured growth, prestige. FinTech: innovation, equity upside, faster pace. Choose based on risk appetite and career goals.imperialbschool+1

Q8: Are finance jobs recession-proof?

A: Mostly yes. Accounting, risk management, compliance are always needed. Investment banking and wealth management slow during recessions but don’t disappear.imperialbschool

Q9: How important is networking?

A: Critical! 70% of jobs filled through referrals. Attend events, use LinkedIn actively, conduct informational interviews. Networking often beats qualifications.linkedin

Q10: Best city for finance jobs in India?

A: Mumbai (financial capital), Bangalore (FinTech hub), Delhi-NCR (corporate finance), Hyderabad (growing FinTech). Mumbai offers most opportunities.linkedin

Final Action Plan: Your Next 90 Days

Days 1-30: Foundation

✅ Complete Excel advanced course

✅ Pass NISM/NCFM certification

✅ Build 2-3 finance projects

✅ Update resume and LinkedIn

✅ Start networking on LinkedIn

Days 31-60: Application Blitz

✅ Apply to 100+ positions

✅ Connect with 50+ professionals

✅ Attend 3-5 networking events

✅ Prepare interview answers

✅ Practice technical questions

Days 61-90: Interview & Close

✅ Ace interviews

✅ Follow up professionally

✅ Negotiate offers

✅ Accept your dream finance role

✅ Prepare for Day 1

Resources to Bookmark

Learning Platforms:

- Corporate Finance Institute (CFI)

- Coursera (Finance specializations)

- Udemy (Excel, SQL courses)

- Khan Academy (Finance basics)

News & Insights:

- Economic Times

- Mint

- Bloomberg

- Financial Express

- Moneycontrol

Networking:

- LinkedIn (Finance groups)

- CFA Society events

- FinTech meetups

- College alumni networks

Job Search:

- LinkedIn Jobs

- Naukri.com

- AngelList (startups)

- Company career pages

Closing Thoughts

Finance in 2025 offers incredible opportunities—whether you choose traditional banking, high-octane investment banking, strategic corporate finance, or cutting-edge FinTech. The key is to start with clarity about your goals, build relevant skills, and take consistent action.imperialbschool

Remember:

- Every CFO started as an analyst

- Every successful banker had their first nervous interview

- Every FinTech founder learned finance step by step

Your finance career journey starts with a single step. Take it today. This guide has given you the roadmap—now it’s time to execute.

Good luck!