Corporate Finance & FP&A Careers

Table of Contents

What Is Corporate Finance? (The CEO's Money Team)

Every company—whether it’s Infosys, Reliance, or a mid-size startup—has a corporate finance team. Their job? Make sure the company makes money and spends it wisely.

Simple example:

- Your company earns ₹100 crore annually

- Expenses: ₹60 crore

- Profit: ₹40 crore

- Question: Should we spend ₹30 crore to expand? Will it generate ₹50+ crore revenue? Corporate finance team analyzes and recommends.imperialbschool

Key difference from investment banking:

- Investment Banking: Advises OTHER companies (external)

- Corporate Finance: Manages company’s OWN money (internal)

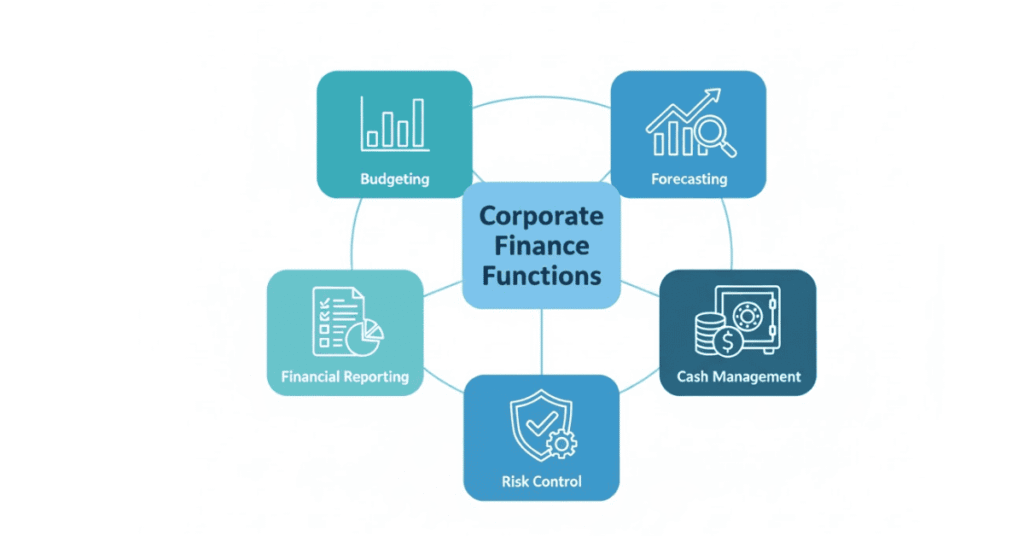

Core Functions of Corporate Finance

- Financial Planning & Analysis (FP&A)

What they do:

- Create annual budgets (what you’ll spend this year)

- Forecast revenue and expenses

- Analyze performance vs. budget

- Recommend strategies to improve profitability

Real example:

An e-commerce company’s sales are down 20% in Q3. FP&A team analyzes:

- What’s the root cause? (Competition? Marketing issues? Product problems?)

- What’ll the full year look like if this continues?

- What actions can turn this around?

- What’ll be the financial impact?

Salary: ₹10-15 LPA (FP&A Analyst) → ₹35-60 LPA (FP&A Director)

- Treasury Management

What they do:

- Manage company’s cash (where to put it, how much liquidity needed)

- Manage debt (loans, bonds)

- Handle forex (if company operates globally)

- Manage investments and working capital

Real example:

A tech company has ₹200 crore cash. Treasury team decides:

- Keep ₹50 crore for operations (working capital)

- Invest ₹100 crore in government bonds (safe, returns 6%)

- Invest ₹50 crore in mutual funds (higher risk, higher returns)

Salary: ₹12-18 LPA (Treasurer) → ₹30-50 LPA (Senior roles)

- Accounting & Financial Reporting

What they do:

- Record all financial transactions

- Prepare financial statements (P&L, Balance Sheet, Cash Flow)

- Ensure compliance with accounting standards (Ind AS, IFRS)

- Prepare tax filings

Why it matters:

Investors, banks, and regulators need accurate financial statements to trust your company.

Salary: ₹4-8 LPA (Accountant) → ₹15-30 LPA (Controller)

- Internal Audit & Risk Management

What they do:

- Verify all financial processes are correct and compliant

- Identify risks and weaknesses

- Recommend improvements

- Ensure company follows regulations

Salary: ₹10-15 LPA (Auditor) → ₹25-40 LPA (Head of Audit)

FP&A: The High-Growth Career Path

FP&A (Financial Planning & Analysis) is the fastest-growing corporate finance role. Here’s why:

- Direct impact on company strategy: Your analysis directly influences CEO decisions

2. Visibility: Present to senior leadership, board of directors

3. Career growth: Clear path to CFO

4. Salary: Competitive and growing

5. Transferable skills: Valuable everywhere

FP&A Analyst: Your Entry Point

What an FP&A analyst does daily:

Morning (9 AM – 1 PM):

- Review overnight reports and emails

- Check previous day’s market performance

- Pull data from ERP systems (SAP, Oracle)

- Build initial analysis and dashboards

- Attend team standup meeting

Afternoon (1 PM – 5 PM):

- Build financial models (forecast revenue, analyze profitability)

- Investigate variances (why is sales ₹2 crore under budget?)

- Prepare presentation slides

- Help senior analyst on larger projects

- Attend meetings with business units

Late afternoon (5 PM – 6:30 PM):

- Finalize reports and send to manager

- Follow up on pending data requests

- Plan tomorrow’s priorities

Work environment:

- Collaborative (work with sales, operations, marketing teams)

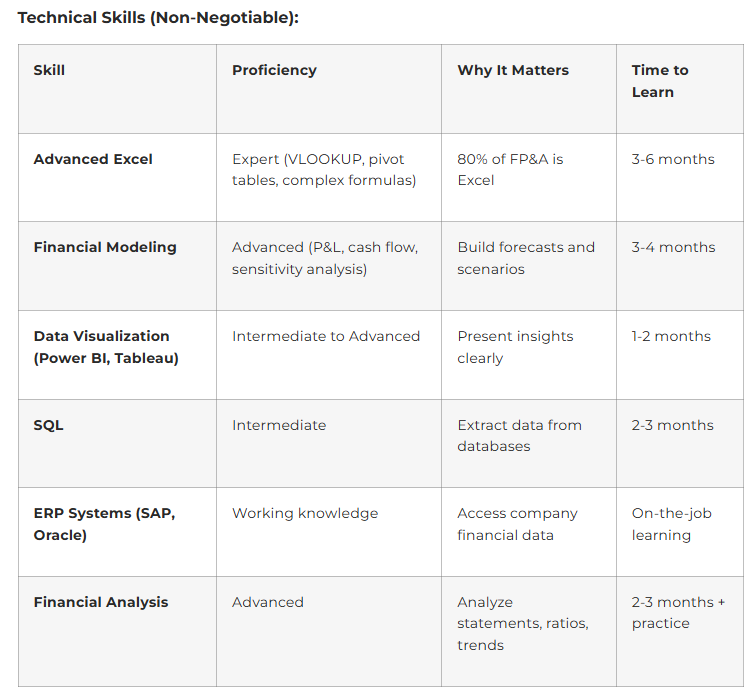

- Data-driven (90% of time in Excel, Power BI, or SQL)

- Fast-paced (quarterly close is hectic, other times moderate)

- Results-oriented (your analysis influences decisions)

Business Skills (Critical):

- Business acumen: Understand how the company makes money

- Communication: Explain complex analysis to non-finance people

- Problem-solving: Find root causes and recommend solutions

- Time management: Balance multiple projects

- Attention to detail: Errors in forecasts can cost millions

- Stakeholder management: Work effectively with sales, marketing, operations

How to Break Into FP&A

Step 1: Educational Foundation

During College:

- Major in Finance, Accounting, Commerce, or Business

- Take courses: Corporate Finance, Financial Analysis, Accounting

- Excel proficiency: Start learning now

- Certifications: CFA Level 1, CA/CPA helps but not essential

GPA & Internships:

- GPA matters initially (3.0+); experience matters more later

- Internship in corporate finance, accounting, or analysis

Step 2: Internship Strategy

Target: Companies with robust FP&A functions

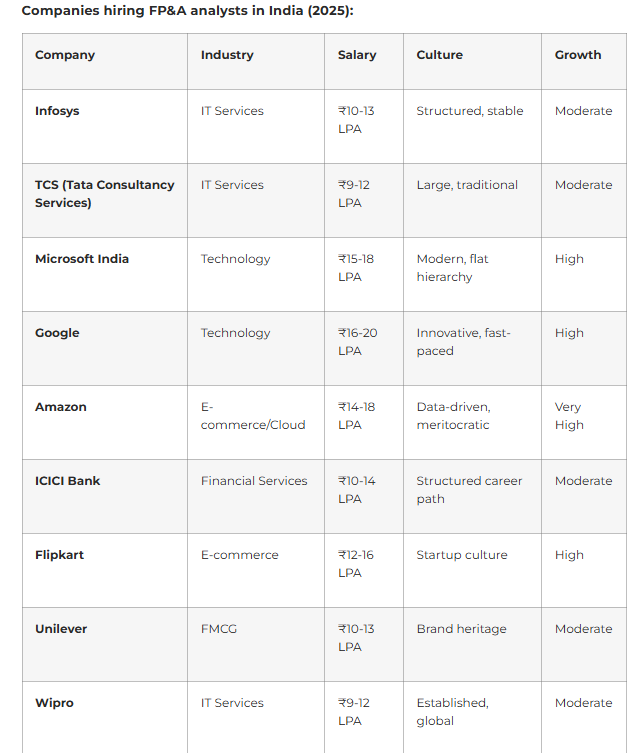

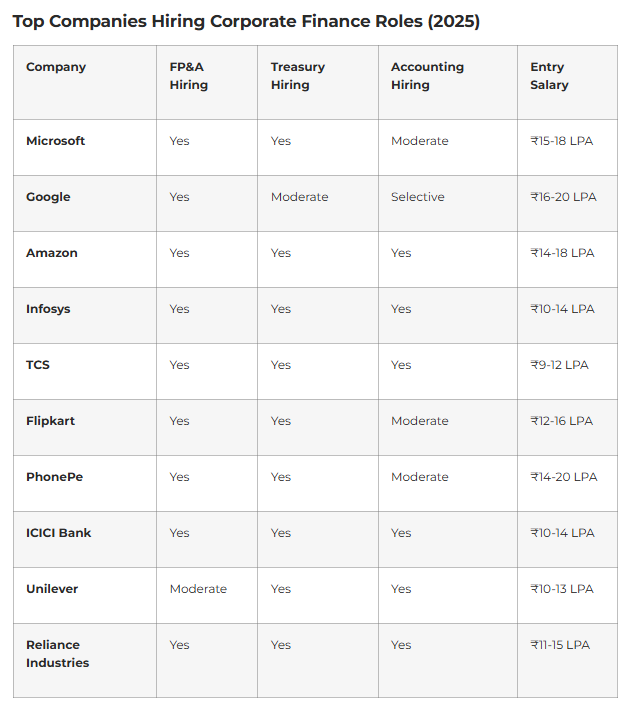

- Large MNCs: Infosys, TCS, Accenture, Microsoft, Google

- Financial institutions: ICICI, HDFC, Kotak

- Startups: Growing tech companies hiring FP&A support

During internship:

- Learn company’s business model deeply

- Master Excel and financial reporting systems

- Build relationships with FP&A team members

- Deliver high-quality work

Internship to full-time: Most companies hire 30-40% of interns, so perform well

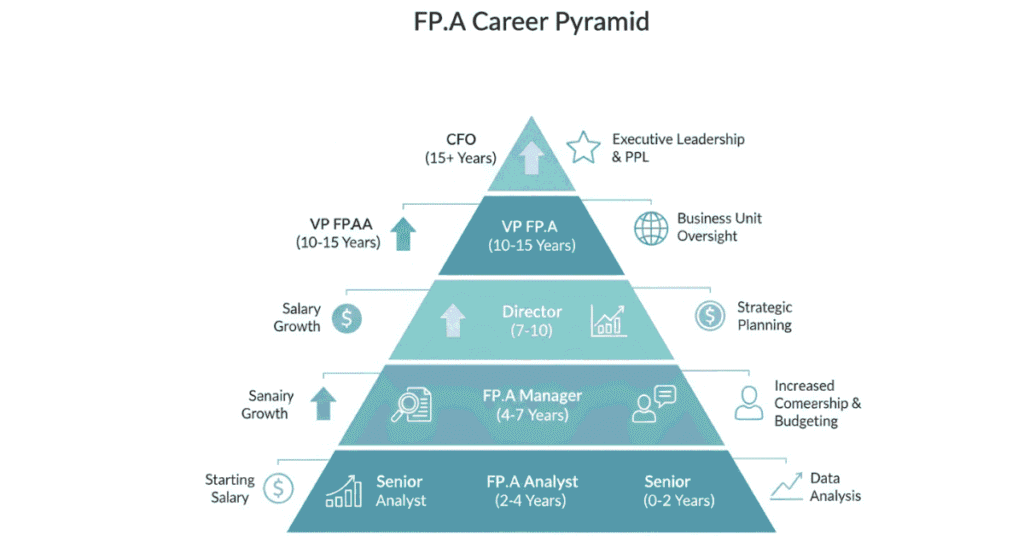

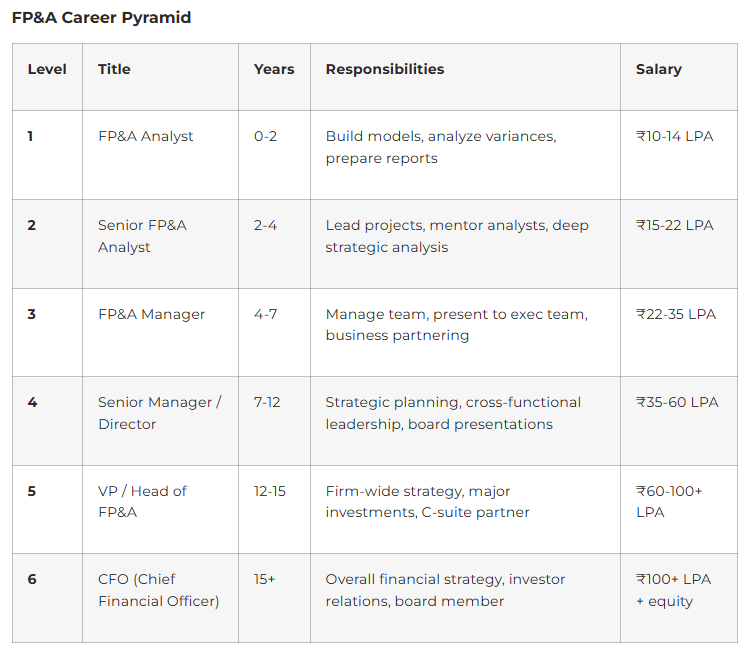

FP&A Career Progression: Your 10-Year Journey

Years 1-2: FP&A Analyst (Learning Phase)

- Responsibilities:

- Build financial models under supervision

- Analyze monthly variances (why did sales miss target?)

- Prepare budget packages

- Support quarterly/annual close

- Salary: ₹10-14 LPA

- Work hours: 45-50 hours/week (manageable)

- Challenges: Learning company’s business, mastering tools

- Success metrics: Accuracy, timeliness, quality of analysis

- Key question to ask senior: “What skills do I need to move to Senior Analyst?”

Years 2-4: Senior FP&A Analyst (Building Expertise)

- Responsibilities:

- Lead forecasting projects

- Mentor junior analysts

- Present to business unit leaders

- Deep analysis of business drivers

- Start thinking strategically

- Salary: ₹15-22 LPA

- Work hours: 50-55 hours/week (busier during close)

- Key milestone: First presentation to senior management

- Next step consideration: Move to Manager or pivot to another finance role?

Years 4-7: FP&A Manager (Leadership Starts)

- Responsibilities:

- Manage team of 2-4 analysts

- Partner with business units (sales, product, operations)

- Lead annual planning and budgeting

- Present strategy to C-suite

- Drive process improvements and automation

- Salary: ₹22-35 LPA

- Work hours: 50-60 hours/week

- New challenge: Managing people (different from analysis)

- High-visibility work: Your analysis influences company strategy

- Bonus consideration: May receive 15-25% of base salary

Years 7-12: Senior Manager / Director (Strategic Role)

- Responsibilities:

- Lead multiple FP&A projects across business units

- Present to board of directors

- Drive company-wide financial strategies

- Hire and develop managers

- 3-5 year strategic planning

- Salary: ₹35-60 LPA

- Work hours: 50-60 hours/week (event-driven)

- Bonus/ESOP: 20-40% of base + stock options

- Visibility: Board-level exposure, investor calls

Year 12+: VP / Head of FP&A (Executive Level)

- Responsibilities:

- Lead entire FP&A function

- Report directly to CFO

- Company-wide financial strategy

- C-suite partner on major decisions

- M&A analysis, fundraising support

- Salary: ₹60-100+ LPA + equity

- Work hours: Variable (55-70 during busy periods)

- Bonus: 30-50% of base + significant equity

The Path to CFO (Chief Financial Officer)

Not all CFOs come from FP&A, but FP&A is a strong foundation.

Typical CFO journey:

Example 1: Direct FP&A Path

- FP&A Analyst (2 yrs) → Senior Analyst (2 yrs) → Manager (3 yrs) → Director (4 yrs) → VP FP&A (3 yrs) → CFO (10+ yrs experience)

Example 2: Mixed Path (More Common)

- FP&A (4 yrs) → Controller/Accounting (3 yrs) → Treasury Head (2 yrs) → Finance Director (3 yrs) → CFO

Example 3: External Path

- Investment Banking (5 yrs) → Corporate Finance (4 yrs) → CFO

CFO Salary in India (2025):

- Small companies (₹100-500 crore revenue): ₹60-100 LPA

- Mid-sized companies (₹500-2000 crore): ₹100-200 LPA

- Large companies (₹2000+ crore): ₹200-400+ LPA (+ equity)

- Top startups: ₹150-300+ LPA (+ significant equity)

Corporate Finance Roles Beyond FP&A

Treasury Manager

What they do:

- Manage company’s liquid assets (cash)

- Optimize investments and borrowing

- Handle foreign exchange

- Ensure sufficient liquidity

Salary: ₹15-25 LPA (manager) → ₹40-60 LPA (senior)

Similar to: Investment management but internal focus

Best for: People who love financial instruments and markets

Financial Controller

What they do:

- Oversee all accounting and financial reporting

- Ensure compliance and accuracy

- Manage accounting team

- Prepare financial statements for stakeholders

Salary: ₹12-20 LPA (controller) → ₹35-60+ LPA (senior controller)

Best for: Detail-oriented people who love processes and compliance

Head of Audit / Internal Audit Manager

What they do:

- Verify financial accuracy

- Identify risks and control weaknesses

- Ensure compliance with regulations

- Recommend improvements

Salary: ₹12-18 LPA (manager) → ₹30-50 LPA (head)

Best for: Process-oriented people who care about accuracy and compliance

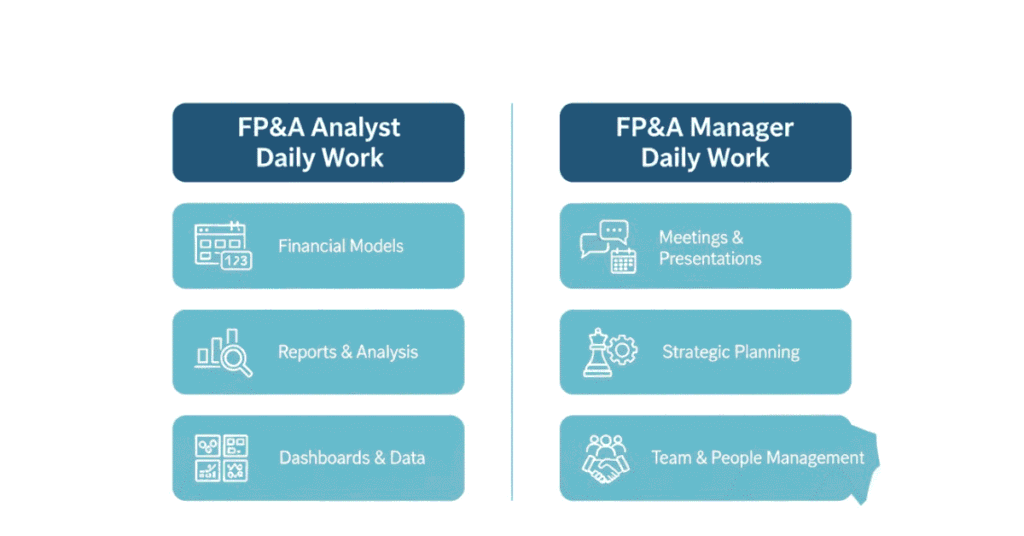

Day in the Life: FP&A Manager (vs. FP&A Analyst)

FP&A Analyst Day:

text

8:45 AM – Arrive, review emails and overnight reports

9:00 AM – Team standup: What are we working on?

9:30 AM – Build revenue forecast model for Q4

11:00 AM – Revise model based on sales team input

1:00 PM – Lunch

2:00 PM – Analyze YTD variances (why are we ₹5 crore over budget?)

3:30 PM – Present findings to senior analyst

4:00 PM – Create slides for manager’s presentation to exec team

5:30 PM – Final checks, send to manager

6:00 PM – Go home

FP&A Manager Day:

text

8:30 AM – Arrive, check overnight reports and forecasts

9:00 AM – Team meeting: Project updates, prioritize work

9:30 AM – One-on-ones with 2-3 analysts (check in, development)

10:30 AM – Meeting with Sales VP: Understand pipeline, refine forecast

11:30 AM – Strategy meeting with CFO: Discuss quarterly close insights

12:30 PM – Lunch (with client or team bonding)

1:30 PM – Work on annual budget presentation for board

3:00 PM – Review analyst work, provide feedback

4:00 PM – Email catch-up, follow-ups

4:30 PM – Prep for tomorrow’s exec presentation

5:30 PM – Final review, send deliverables

6:30 PM – Leave (or stay if big project)

Key difference: Manager’s day is more people-focused, strategic, and visible.

Day in the Life: FP&A Manager (vs. FP&A Analyst)

How to Get Promoted Faster in Corporate Finance

Secret 1: Master the Company’s Business

- Understand revenue drivers (what makes the company money?)

- Know the competitive landscape

- Follow industry trends

- Ask smart questions about strategy

Secret 2: Build Cross-Functional Relationships

- Work closely with sales, product, operations

- Understand their challenges

- Become their trusted finance advisor

- They’ll advocate for your promotion

Secret 3: Automate & Innovate

- Find repetitive tasks and automate (Excel macros, scripts)

- Propose process improvements

- Implement new tools (Power BI, new forecasting models)

- Managers notice efficiency drivers

Secret 4: Develop Others

- Mentor junior analysts

- Share knowledge freely

- Help colleagues succeed

- Promotions go to people who can develop talent

Secret 5: Think Like the CFO

- Don’t just answer questions; anticipate needs

- Provide strategic insights, not just data

- Think about business impact, not just numbers

- Present solutions, not just problems

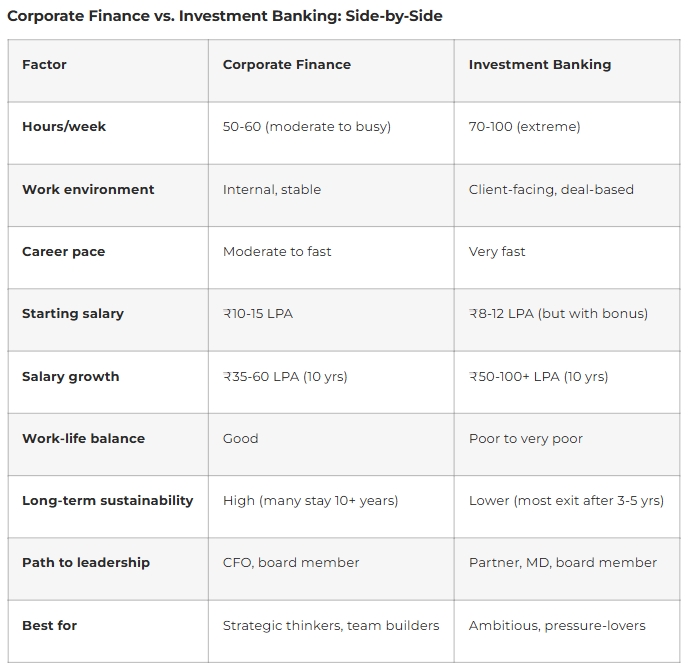

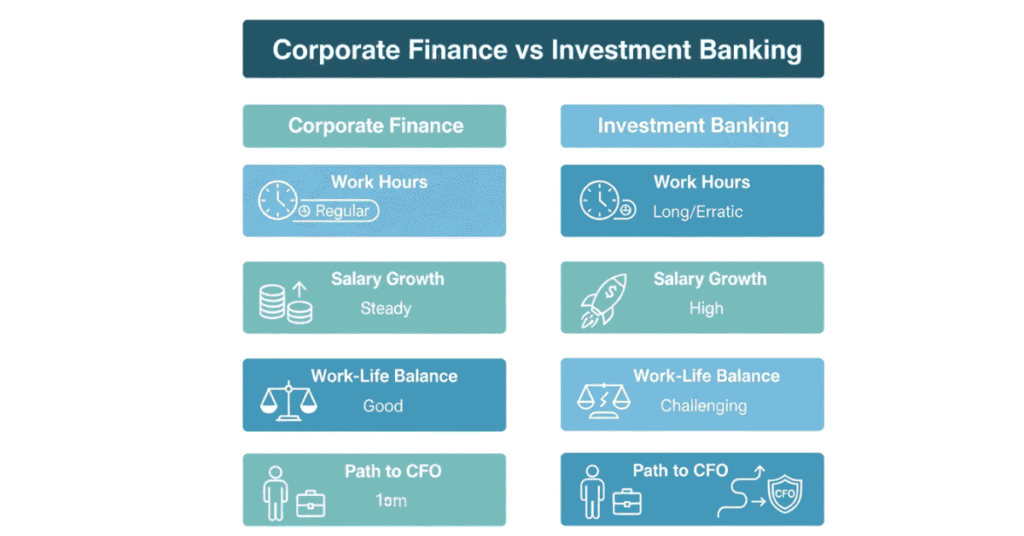

3 Reasons to Choose Corporate Finance

- Better Work-Life Balance Than Banking

- 50-60 hour weeks vs. 70-100 in investment banking

- You can have a life, relationships, hobbies

- No 2 AM calls from clients

- Weekends mostly yours

- Sustainable Long-Term Career

- People stay in corporate finance 10-20+ years

- Clear path to executive leadership (CFO, board)

- Skills appreciated across industries

- Can transition to startups, PE, consulting

- Strategic Visibility Without the Grind

- Present to C-suite and board (investment banker do this too, but later)

- Influence company strategy directly

- See impact of your recommendations

- Build deep business understanding

Investment Banking vs. Corporate Finance: Make Your Choice

Choose Investment Banking IF:

- You want fastest salary growth

- You thrive under extreme pressure

- You’re willing to sacrifice years 1-5 for long-term gain

- You value prestige and network

- You want exit options (PE, VC, hedge funds)

Choose Corporate Finance IF:

- You want sustainable career

- You value work-life balance

- You want to lead organizations (CFO path)

- You prefer strategic thinking to deal execution

- You want to stay with one company long-term

Hybrid Approach: Many successful finance leaders do investment banking (3-5 years for skills + prestige) then move to corporate finance (better lifestyle + leadership path).