Determining between the fixed-rate mortgage and adjustable-rate mortgage is among the major decisions that homebuyers have to make, as it then determines their monthly payments, long-term planning, and overall experience. This blog post explores and explains what the difference is, what advantages and disadvantages may be made of each type.

Understanding Fixed-Rate Mortgages

A fixed rate mortgage features an interest rate that is always the same for the life of the loan. This stability means your monthly principal and interest payments do not change, which makes budgeting easy. Fixed rate mortgages are usually provided in a variety of terms, with 30 year and 15 year being the most common.

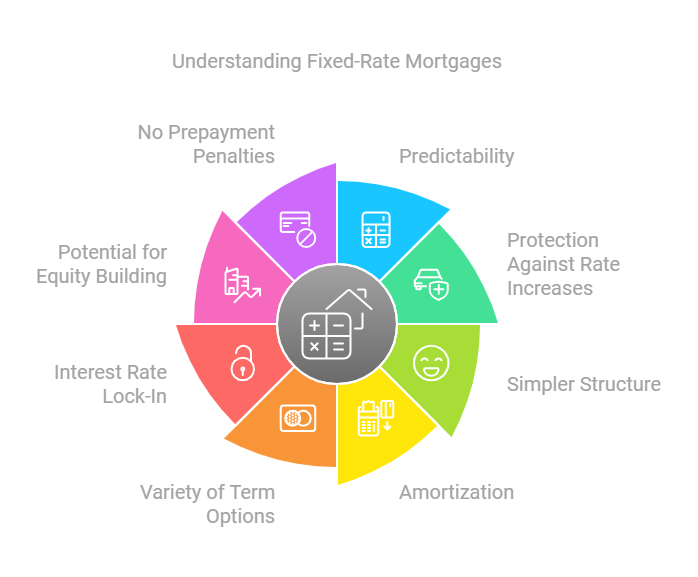

Key Features of Fixed-Rate Mortgages

Fixed-rate mortgages (FRMs) are a popular choice among homebuyers due to their stability and predictability. Here are several key features that make fixed-rate mortgages appealing:

1. Predictability: Monthly payments continue to be solid throughout the loan term, allowing house owners to finance efficiently without disturbing approximately fluctuating interest charges. This consistency aids in long-term financial planning.

2. Protection Against Rate Increases: Borrowers are protected from potential will increase in interest quotes over the years. This method that although market quotes rise, the borrower’s rate stays unchanged, protecting them from higher payments that might strain their finances.

3. Simpler Structure: Fixed-rate mortgages are easier to understand than ARMs. They do not involve complicated adjustments or market indices, making them simpler for borrowers.

4. Amortization: Fixed-rate mortgages are regularly absolutely amortized-so every month can pay interest and principal and therefore, guarantees that one of these loans is paid off on the give up of the time period. It clearly indicates how plenty each price reduces the major as compared to paying interest.

5. Variety of Term Options: Borrowers can pick from extraordinary mortgage phrases that are normally between 10 and 30 years. The flexibility allows individuals to choose a term that best fits their goals and comfort in paying it off.

6. Interest Rate Lock-In: After the closing, the interest rate set is fixed and does not change throughout the life of the loan. This prevents borrowers from the uncertainty of future market volatility.

7. Potential for Equity Building: With regular payments targeted at reducing the principal amount, homeowners can increase the equity in their property over time. This equity can be used to service future financial needs or at the time of selling the house.

8. No Prepayment Penalties (in Many Cases): Many fixed-rate mortgages allow borrowers to make extra payments or pay off the loan early without any prepayment penalties, so borrowers can reduce their total interest costs if they want to pay off their mortgage sooner.

9. Commonly Accepted by Lenders: Fixed-rate mortgages are highly recognized and accepted by lenders. Therefore, most homebuyers take this as a standard option. This broad acceptance simplifies the mortgage process and enhances accessibility.

10. Stable Housing Costs: Whereas property taxes and insurance might vary, the core mortgage payment does not change. This is what makes overall housing costs stable over time.

11. Lower Risk During Inflation: Borrowers holding fixed fee mortgages may also benefit sometimes when inflation is too high because their payments are always constant while the real price of those payments decreases through time.

12. Good for Long-Term Planning: Fixed rate mortgages become very ideal for people whose plans are to stay at home for a long duration; therefore, this serves to give the individual peace psychologically concerning future financial liabilities.

By understanding these features, potential homeowners can better assess whether a fixed-rate mortgage aligns with their financial situation and long-term goals.

Advantages of Fixed Rate Mortgage

1. Stability: Ideal for long-term homeowners who prefer predictable payments.

2. Easier Qualification: Generally more straightforward for first time buyers to understand and qualify for.

Disadvantages of Fixed Rate Mortgage

1. Higher Initial Rates: Fixed-rate mortgages often start with higher interest rates compared to ARMs.

2. Less Flexibility: If market rates fall, borrowers cannot benefit unless they refinance their loan.

Understanding Adjustable-Rate Mortgages (ARMs)

An adjustable rate mortgage is one whose interest rate varies at fixed intervals after some introductory period of fixed rates. The introductory period is usually between three to ten years. Once the introductory period is over, the rate is periodically adjusted according to market conditions.

Key Features of Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) offer unique features that can make them appealing to certain homebuyers. Here are some key characteristics that define ARMs:

1. Lower Initial Rates: ARM usually offers lower initial rates compared to a fixed-rate mortgage. This makes it popular among many buyers who are searching for affordability in their first years of homeownership.

2. Adjustment Periods: Following the initial set timeframe, which varies from more than one month to several years, the interest rate may additionally trade at scheduled instances—month-to-month, biannually, or yearly—depending on a benchmark index plus an additional margin decided by the lender. This design permits borrowers to probably take advantage of reduced fees in case marketplace conditions are favorable.

3. Rate Caps: Virtually all ARMs contain rate caps, which establish a maximum by which the interest rate may rise with each adjustment and over the entire life of the loan. This provision limits large increases in monthly payments and thus somewhat safeguards consumers from their potential financial risk.

4. Hybrid Structure: Many ARMs are hybrid loans, meaning they start with a fixed interest rate for a specified period (e.g., 5/1 ARM means fixed for 5 years, then adjustable annually). This structure allows borrowers to enjoy the stability of fixed payments initially before transitioning to adjustable rates.

5. Potential for Payment Shock: While ARMs can start with lower payments, borrowers must be aware of potential “payment shock” when rates adjust upward after the initial period. This could lead to significantly higher monthly payments if market rates have risen.

6. Index and Margin: The interest rate adjustments are based on an index (a benchmark interest rate) plus a margin (a fixed percentage added by the lender). The specific index used can affect how much your rate changes over time, making it crucial for borrowers to understand these components.

7. Interest-Only Options: Some ARMs offer an interest-only payment option during the initial period, allowing borrowers to pay only the interest for a set time. While this reduces initial payments, it does not decrease the principal balance during that period.

8. Conversion Options: Some programs with ARM allow a borrower to convert an ARM into fixed-rate mortgage after some period, enabling them to be flexible if circumstances in the market change, or personal financial situations arise.

9. Good for Short-Term Homeowners: ARMs can be particularly beneficial for buyers who plan to sell or refinance before the first adjustment occurs, enabling them to take advantage of lower initial rates without facing future rate increases.

10. Equity Building Potential: During the initial fixed-rate period, homeowners can build equity of their assets at a decreased price, which may be fine in the event that they plan to promote within some years.

11. Financial Planning Considerations: Borrowers should carefully assess their financial situation and future plans when considering an ARM. Understanding how potential rate changes could impact monthly payments is essential for effective budgeting and long-term planning.

12. Market Sensitivity: Since ARMs are tied to market indices, borrowers should be aware that economic changes can affect their mortgage costs significantly over time. Keeping an eye on economic indicators can help anticipate potential adjustments in mortgage payments.

By understanding these features, potential borrowers can make informed decisions about whether an adjustable-rate mortgage aligns with their financial goals and risk tolerance.

Advantages of Adjustable-Rate Mortgage

- Lower Initial Payments: The lower starting rate can make homeownership more affordable initially.

- Potential for Decreasing Rates: If market rates decline, borrowers benefit from lower payments without needing to refinance.

Disadvantages of Adjustable-Rate Mortgage

1.Payment Uncertainty: Monthly payments may increase significantly after the initial period, making budgeting more challenging.

2. Complexity: Understanding how ARMs work requires familiarity with terms like adjustment frequency, index rates, and margins.

Comparing Fixed-Rate Mortgages and ARMs

When deciding between a fixed rate mortgage and an ARM, several factors come into play:

| Features | Fixed-Rate Mortgage | Adjustable-Rate Mortgage |

|---|---|---|

| Interest Rate | Constant through out the loan | Variable after initial payment |

| Initial Payment | Higher than ARM's | Lower than fixed rate |

| Long-Term stability | High | Low |

| Complexity | Simple | More complex |

| Best for | Long-term home owners | Short term home owners or those expecting income growth |

Who Should Choose a Fixed-Rate Mortgage?

1. Long Term Homeowners: While constant-price mortgages offer predictability and ease for the long-term owner of a house in making plans for the monthly bills, additionally they do have safety towards better interest charges within the destiny, saving cash to the borrower in a growing rate environment through locking right into a lower price.

2. First-Time Buyers: First-time homebuyers gain from simplified budgeting with constant-rate mortgages, helping them manipulate finances effectively and reduce pressure. Accessible alternatives consist of fixed-rate loans with lower down bills and flexible phrases, making homeownership more affordable. Longer constant phrases, together with 30 years, bring about lower month-to-month payments and help customers build fairness over time.

3. Budget Conscious Individuals: Fixed-price mortgages provide consistency in payments, making monetary making plans less complicated for those on a strict budget or with constant earning. Borrowers can expect costs without traumatic hobby price fluctuations, critical for handling debts and obligations.

Who Should Consider an Adjustable-Rate Mortgage?

1. Short-Term Homeowners: If you plan to sell or refinance before the adjustable period begins, you can take advantage of lower initial payments without facing future rate hikes.

2. Individuals Expecting Income Growth: If you anticipate significant salary increases or financial windfalls in the future, you may be better equipped to handle potential payment increases associated with ARMs.

3. Market Savvy Buyers: Those who closely monitor interest rates may find ARMs advantageous during periods of declining rates.

Making Your Decision

When choosing between a fixed rate mortgage and an ARM, consider your personal financial situation and future plans:

1. Duration of Stay in Home: How long do you intend to live in the property? Shorter stays may favor ARMs due to lower initial costs.

2. Financial Stability: Can you comfortably manage potential payment increases if you choose an ARM? Assess your financial cushion against possible future rate hikes.

3. Interest Rate Trends: What are your expectations for future interest rates? If rates are high but expected to fall, an ARM might be beneficial.

Conclusion

Both fixed-rate and adjustable-rate mortgages have merits and demerits. Where one is suitable for someone else, it may turn out to be unsuitable for another. The level of suitability will depend directly on your financial status, where you expect to stay or live in your home and the level of risk a person is willing to afford.

Based on these above factors, by conducting such appropriate research and consulting experts like financial planners, this choice can be made.

Choose a fixed rate mortgage for stability and predictability if you plan to stay long-term or prefer simplicity. Opt for an adjustable rate mortgage if you’re looking for lower initial payments and plan on moving before significant adjustments occur or expect increased income in the future.

Understanding these options will empower you to navigate the complexities of home financing effectively.

To read more on Mortgage topics CLICK HERE