CORPORATE LAWYER CAREER GUIDE

Table of Contents

Introduction:

Walk into any boardroom where billion-rupee deals get finalized, and you’ll find corporate lawyers shaping the conversation. You’re not just drafting contracts—you’re structuring mergers that create market leaders, negotiating private equity investments fueling growth, and designing compliance frameworks protecting corporate empires. Corporate law sits at the exciting intersection of business strategy, finance, and legal expertise.

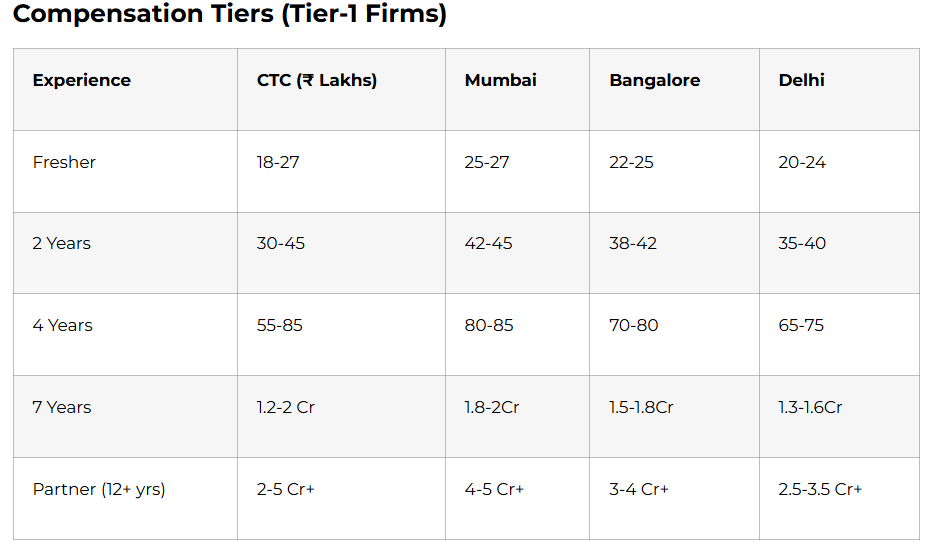

India’s corporate legal market is exploding. With $150+ billion in FDI annually, 100,000+ startups seeking funding, IPO boom creating 200+ listings yearly, and MNCs establishing India HQs, demand for corporate lawyers has never been higher. Tier-1 law firms pay freshers ₹18-25 lakhs, mid-level lawyers ₹40-80 lakhs, and partners ₹2-5 crores annually. Mumbai, Bangalore, and Delhi-NCR host India’s corporate law powerhouses where fortunes get made.

Corporate law offers clear meritocracy—work quality directly determines compensation and partnership tracks. If you thrive in high-pressure deal environments, enjoy financial modeling combined with legal drafting, and want to partner directly with CEOs/CFOs on growth strategies, corporate law provides one of India’s most lucrative legal careers.

What Corporate Lawyers Actually Do

The Architects of Business Growth

Corporate lawyers don’t litigate—they build. When Reliance acquires a cement company for ₹8,000 crore, corporate lawyers structure the deal, negotiate terms, conduct due diligence, draft 300-page agreement, and obtain regulatory approvals. When a unicorn startup raises $100 million Series C, you’re negotiating shareholder rights, liquidation preferences, and board compositions with VCs.

Your work creates tangible business outcomes. Flawless M&A execution builds market leaders. Sophisticated financing structures enable expansion. Robust governance frameworks attract institutional investors. Poor corporate lawyering destroys value through deal failures, regulatory blocks, or shareholder disputes.

Core Practice Areas

Mergers & Acquisitions (M&A): Structuring acquisitions, joint ventures, asset purchases. You’ll negotiate purchase price adjustments, indemnities, earn-outs, and non-competes. PE-backed deals (70% of large transactions) require sophisticated structuring balancing investor protections with seller liquidity.

Private Equity & Venture Capital: Advising PE funds/VCs on investments, portfolio company governance, exit strategies. Portfolio work involves quarterly compliance, financing amendments, and strategic M&A.

Capital Markets: IPOs, QIPs, rights issues, bond issuances. SEBI compliance, prospectus drafting, roadshow support, stock exchange listings. Freshers cut their teeth on these high-volume transactions.

Banking & Finance: Debt financing, ECBs, NCDs, structured finance. Negotiating facility agreements, security documents, intercreditor agreements. Project finance work involves PPA structuring, EPC contracts.

Corporate Restructuring: IBC proceedings, scheme of arrangements, debt restructuring. High-stakes work rescuing distressed businesses through complex stakeholder negotiations.

Daily Life of a Corporate Lawyer

Transaction Lifecycle

Due Diligence (Week 1-4): Reviewing target’s contracts, litigation, compliance, IP, employees. Red flags kill deals or reduce valuations by 20-30%. Your DD report becomes the deal thesis.

Term Sheet Negotiation (Week 4-6): Non-binding commercial terms setting deal economics. VCs push for 1x liquidation preferences, full ratchets; sellers want clean exits.

Definitive Agreement Drafting (Week 6-12): 200-400 page SPA with 50+ definitions, 20+ reps/warranties, complex indemnities, price adjustment mechanics. Markup wars between buyer/seller counsel.

Regulatory Approvals (Week 8-16): CCI clearance (30-day review), SEBI observations (21 days), sector regulator nods (RBI, IRDAI). Timing gaps kill deals.

Closing (Week 12-20): Simultaneous sign-close for public targets; staggered closing for private deals with conditions precedent.

Typical Deal Team Structure

Partner: Strategy, client relationships, high-level negotiation

Senior Associate (5-8 yrs): Complex drafting, regulatory strategy

Junior Associate (1-3 yrs): Due diligence, basic drafting, document management

Trainee: Document organization, basic research, admin support

Freshers spend 70% time on DD, 20% basic drafting, 10% coordination. By year 3, you’re leading workstreams.

Essential Skills for Corporate Law Success

Technical Legal Skills

Companies Act 2013 Mastery: Sections 62/42 (fundraising), 177-185 (related party), 230-240 (mergers), IBC 2016. Every deal touches these provisions.

SEBI Regulations: LODR, ICDR, Takeover Code, SAST. IPOs live/die on compliance.

FEMA & RBI: ECB framework, ODI/FCNR routes, LRS implications for cross-border deals.

Contract Drafting: Commercial agreements with balanced risk allocation. Founders hate over-lawyered docs; investors demand ironclad protections.

Financial Analysis: Reading balance sheets, understanding EBITDA addbacks, working capital peg mechanics, valuation multiples.

Transaction Skills

Due Diligence Expertise: Spotting 20-30% valuation adjustment items buried in contracts/lawsuits. Founders hide issues; your job finds them.

Negotiation: Balancing 15+ variables (price, indemnity caps, escrows, earn-outs) creating win-win economics.

Project Management: Coordinating 10+ workstreams (tax, competition, employment) across 5+ jurisdictions hitting closing timelines.

Stakeholder Management: Managing demanding clients, aggressive counterparts, internal practice group coordination.

Technology Proficiency

Data Rooms: Dealroom, Firmex, Intralinks mastery. 50GB+ document repositories require systematic review approaches.

Document Automation: Kira, Luminance AI contract review accelerating DD by 70%.

Cap Table Management: Carta, Ledgy for startup equity analysis.

Virtual Data Rooms: Intralinks, Merrill for live deal coordination.

Educational Pathways & Entry Requirements

Academic Foundation

National Law School (Tier-1): NLSIU Bangalore, NALSAR Hyderabad top recruiter targets paying ₹20-27 lakhs CTC freshers.

Tier-2 NLUs: NLU Delhi, Jindal Global Law pays ₹16-22 lakhs.

Private Law Schools: Symbiosis, Christ University (₹12-16 lakhs).

CA/CS + Law: Dual qualification commands ₹25+ lakhs starting. Corporate finance understanding trumps pure law skills.

CFA/MBA: Finance background accelerates banking & finance practice.

Entry Routes

Campus Recruitment: 80% of Tier-1 hires through campus interviews. Summer associates convert 90% to pre-placement offers.

Lateral Hiring: 1-3 years PQE from other Tier-1 firms. Same-firm switches rare.

In-House Direct: Rare for freshers; 3+ years experience required.

Summer Associate Program (Critical)

2-month summer training determines 90% pre-placement offers. Top performers get multiple offers.

Focus areas: DD execution speed, drafting clarity, client interaction comfort, stamina (12-hour days).

Conversion rates: Tier-1 NLUs >90%, Tier-2 NLUs 60-80%, others <30%.

Salary Progression & Career Path

Bonuses: 20-50% of base; deal completion driven.

Career Ladder

- Associate (0-3 yrs): Execution focus

- Senior Associate (4-7 yrs): Deal leadership

- Counsel (8-11 yrs): Practice head potential

- Partner (12+ yrs): 1% reach partnership

** attrition:** 25% yearly; burnout common.

Top Corporate Law Firms

Tier-1 Global

- Cyril Amarchand Mangaldas (1,000+ lawyers): M&A king

- AZB & Partners (750+): PE/VC leader

- Shardul Amarchand Mangaldas (800+): Banking powerhouse

- Khaitan & Co (700+): Private equity focus

- Trilegal (650+): Tech transactions

Tier-1 Indian

- J Sagar Associates (JSAs)

- Luthra & Luthra

- Dua Associates

Specialist Boutiques

- IndusLaw (tech startups)

- Veritas Legal (PE)

- Cirrus10 (fintech)

Why Corporate Law?

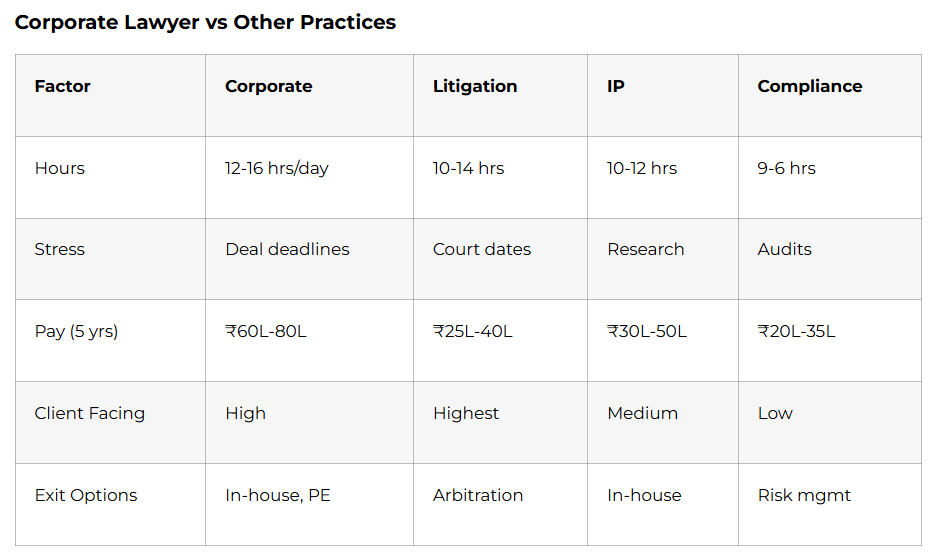

- Highest Pay: 2x litigation, 1.5x IP

- Business Exposure: Direct CEO/CXO interaction

- Exit Opportunities: GC roles ₹1-3 Cr, PE operating partner

- Global Exposure: Cross-border deals standard

The Grind Reality:

- 2,800+ billable hours target

- Zero work-life balance first 5 years

- 50% attrition by year 3

- Partnership = 12-15 years + business development

Success Blueprint

Year 1-2: Execution Excellence

- Master DD checklists

- Perfect document management

- Build stamina (14-hour days)

- Learn financial statements

Year 3-5: Deal Leadership

- Lead DD workstreams

- Draft term sheets/SPAs

- Manage juniors

- Build client relationships

Year 6+: Partnership Track

- Originate deals

- Lead practice groups

- Business development

- Mentor associates

Daily Survival Tips:

text

6 AM: Emails, market updates

8 AM-2 PM: DD/execution

2-6 PM: Drafting/negotiation calls

6 PM-12 AM: Revisions, regulatory

12 AM-2 AM: Client calls (US time)

Long-Term Wealth Building:

- Make partner by age 38 (top 1%)

- Lateral to in-house GC (₹2-4 Cr)

- Start specialist boutique

- PE/VC legal advisory

Is Corporate Law Right For You?

You’ll Thrive If:

- Excel under extreme deadline pressure

- Love financial modeling + legal drafting

- Enjoy CXO-level client interaction

- Want maximum earning potential

- Business-oriented rather than pure law

Consider Alternatives If:

- Value work-life balance

- Dislike 2 AM client calls

- Prefer courtroom advocacy

- Excel at deep research vs. execution

Corporate law rewards relentless execution, commercial judgment, and stamina above all. Tier-1 firm associates literally print money for 5-7 years before deciding—partner track, in-house, or entrepreneurship. The hardest, highest-paying legal game in India today.